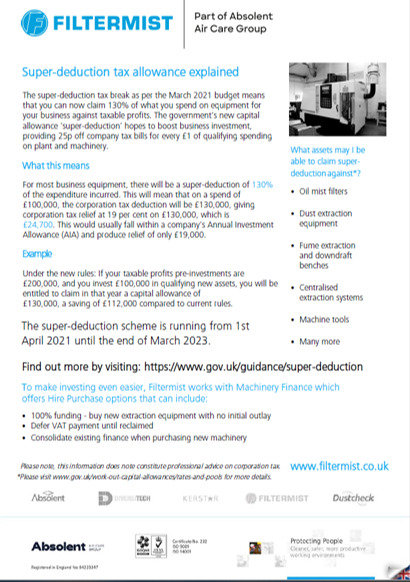

There is still plenty of time for UK manufacturers to take advantage of the super-deduction tax relief scheme which was introduced by the Government on 1st April 2021 and will run until the end of March 2023.

The scheme is designed to support companies with their capital expenditure on qualifying expenditure on ‘productivity enhancing’ plant and machinery. According to the UK Government, ‘Most tangible capital assets used in the course of a business are considered plant and machinery for the purposes of claiming capital allowances.’

The super-deduction capital allowance offers 130% first-year relief on qualifying main rate plant and machinery investments – this means that companies can cut their tax bill by up to 25p for every £1 they invest.

A super-deduction factsheet from the UK Government can be downloaded by following this link.